Things You Need to Know About Writing Letter to IRS

Let us deal with writing a compelling and truthful explanation letter to IRS, strengthening your position for the Tax Office representatives!

Entrust Your Writing Letter to IRS to Us

We strive for the best results achieved with quality writing and a client-focused approach.

Get a 100% unique writing crafted in congruence with your specific state of affairs. An explanation letter to IRS by our authors will accurately describe your particular problem and will help to reduce the claims of the service to zero quickly.

You’re able to contact your writing expert any time you need, and this opportunity is available 24/7. You can text the assigned pro, elucidate some details of the explanation letter to IRS, or ask about how much of the explanation text is ready so far.

You can be sure that your explanation letter to IRS will be written precisely according to all the strict legal requirements. The format will be correct, all details will be accurate, and all writing references will be relevant and support your position.

It seems your writing needs to be checked once more, doesn’t it? After getting the ultimate version of your order, you’re able to have your explanation letter to IRS corrected free of charge for 2 weeks following the deadline.

Our conscientious specialists will do their best to write you the perfect explanation letter to IRS. We know that there are specific standards for such documents, but they must contain the client's required information.

You can get a refund within 14 days of receiving the ordered explanation writing. We’re not scammers, and we don’t aim to hoodwink people! So, don't even be frightened that you'll be deluded with writing letter to the IRS.

Letter of Recommendation

Application Resume/CV

Waiver Request Letter

Statement of Purpose

Personal Statement

Admission Essay

Writing a Letter to the IRS Is Easier With Our Experts

Writing an explanation letter to IRS is a complex task, but not for our experienced and talented writers, who are well-versed in the application docs.

Write Letter to IRS – Review and Comments

How Do We Write a Letter to the IRS?

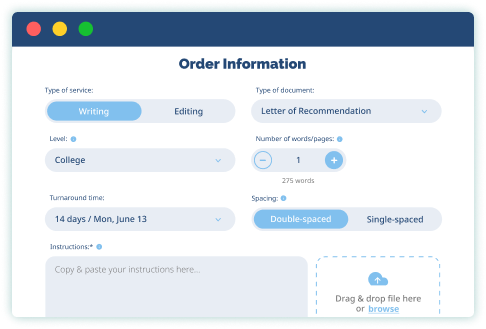

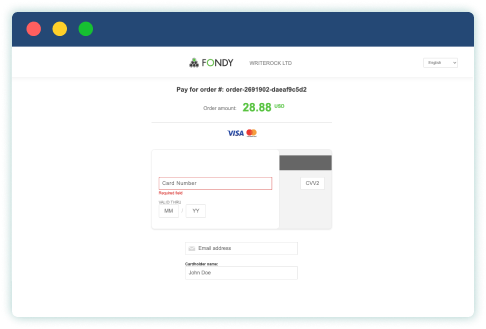

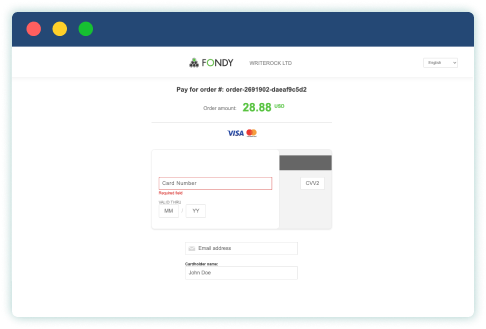

It won’t take much energy: just fill out the form to provide our writing experts with the needed info for explanation letter to IRS and click on the payment button. If you want us to write a letter to the IRS as convincingly as possible, we ask for all the information you might need to write the most convincing explanation that the inspectorate will accept.

- Also, keep in mind that you should fill in our Questionnaire. It will help to draw a fuller picture of your candidacy. When you do it, just add the file to your explanation letter to IRS order form. Don’t worry, all of the information will stay confidential, and no one will get access to it.

After you pay for your explanation letter to IRS, our writing expert will start working an explanation letter to the IRS. Be sure that all financial operations are safe and protected. Furthermore, you will receive a letter confirming the transaction by email.

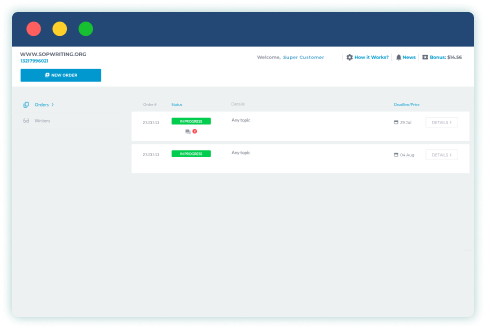

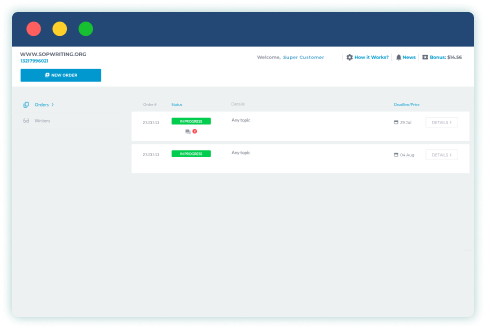

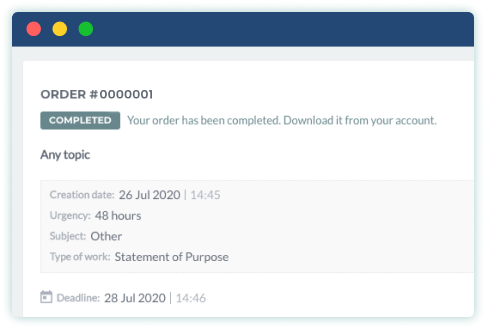

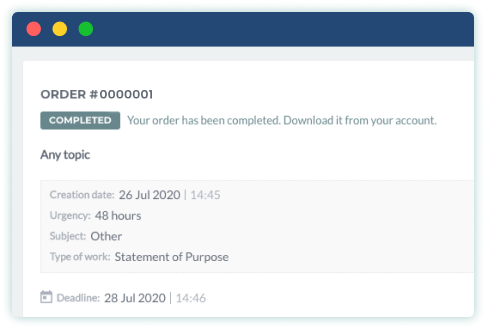

Just after the explanation letter to IRS is paid for, you’ll get access to your private customer area and also details for logging in to it. Here you can modify the explanation letter to IRS if you find it inconvenient. Also, you can communicate with the writing specialists and manager personally. Additionally, you can download your explanation document, ask your writer to revise it, and place more orders.

You’ll be informed about all updates in your explanation writing by email. Also, you can choose to track your orders fully with the help of SMS updates. After your explanation letter to IRS is done, our Quality Assurance team will go through it meticulously by checking if it satisfies all the demands. Writing an explanation letter to IRS is challenging and requires careful and repeated checking and possibly editing. If you want to change something in an explanation letter to IRS, just ask your writer for 14 days. We’ll fix everything in a little while!

Choose the most fitting way to keepaware of the order status.

Chat with your writer, upload the final SoP,and order something new easily.

Don’t hesitate to request help concerningyour order from our agents.

All You Need to Know About Explanation Letter to IRS

An explanation letter to IRS is a complex and responsible writing piece in which it is easy to make mistakes, so very often, people have to write an explanation letter to the tax authorities explaining their failure. Please note that this is not just a letter, as you may face unpleasant consequences for your mistakes.

Therefore, to avoid any penalties, ensure you consider all details and additional materials you’ll need to write letter to IRS properly. You also need to know the structure of writing an explanation letter and the nuances of its design to be sure that you will be all right.

Writing an Explanation Letter – Who Needs It

If you need to explain to the IRS why there is unusual activity in your history, you can start writing an explanation letter in which you present your reasons and explanations in detail.

Depending on the number of violations and their seriousness, you will need to take a different context of explanation letter to IRS. We’ll talk about that later.

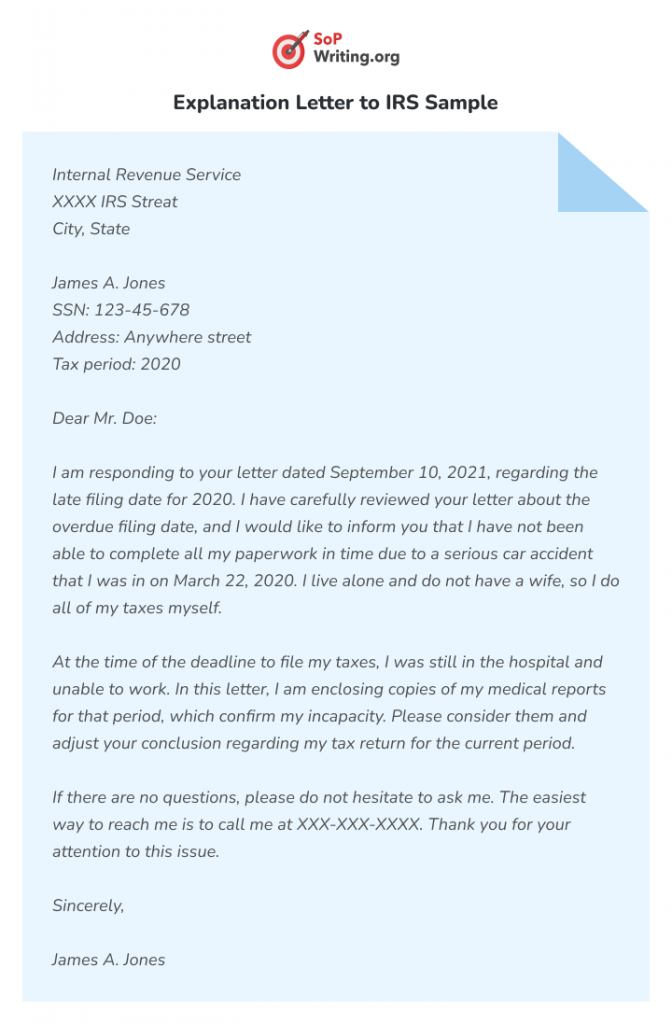

Quality Written Explanation Sample Letter to IRS

Let’s consider the structure of a compelling written explanation sample letter to IRS. We highly recommend you pay attention to these recommendations:

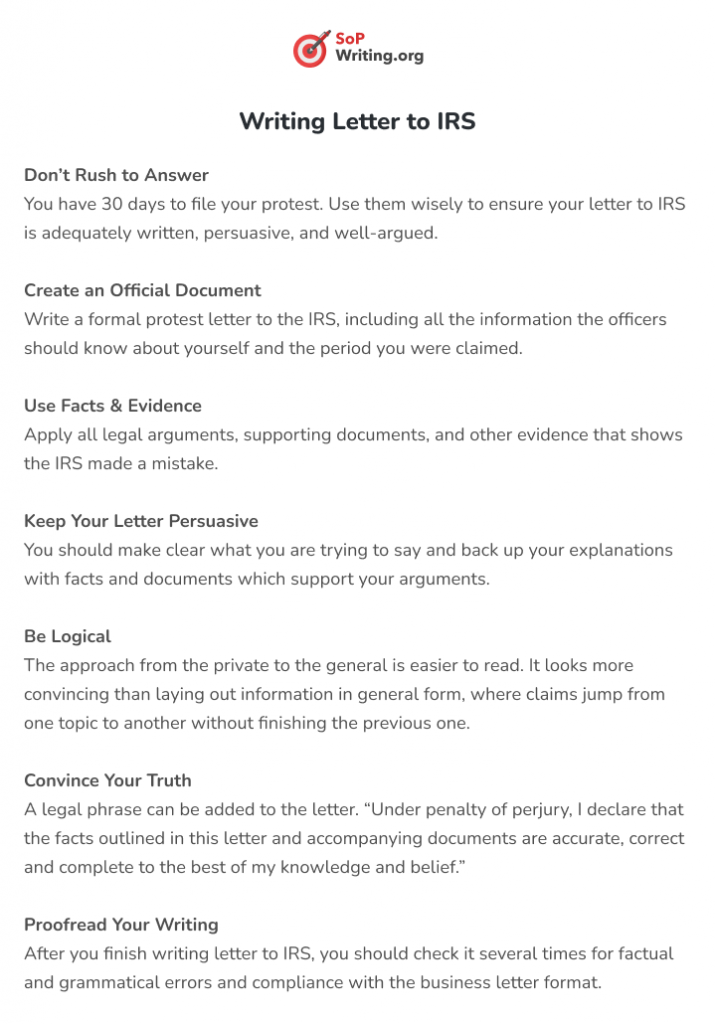

- If you disagree with an IRS report, take the time to sign it. Do not sign and return the report right away. Within 30 days of receiving the IRS explanation letter, you have the right to file a written protest and explain why you disagree with the IRS decision.

- Write an explanation letter without leaving out any necessary details. As with all essential explanation documents, it is crucial to write an explanation letter specifying all the details. It will help the IRS understand your situation and be more loyal. Explain why you disagree with the IRS tax audit results, but don’t forget about a professional tone.

So, your explanation letter to IRS should include the following writing items:

- Name, address, and contact information of the taxpayer.

- An explanation expressing your desire to appeal the IRS conclusions.

- The tax period.

- A list of the points you disagree with and your explanations.

- Facts supporting your position.

- Any law or authoritative document relevant to your explanation.

3. Go over each point and explain your disagreement, using facts and arguments to justify your position. When writing a letter to IRS, it is crucial to gain the trust of your explanations. Therefore, in the beginning, you can concede and agree on some issues. Then it is vital to highlight the controversial problems and support them with facts and explanations. Be as convincing as possible to increase your chances of success.

4. Keep your explanation letter to IRS short and straightforward so you don’t lose the IRS’s interest. Writing a detailed yet concise explanation document is crucial. Writing explanation letter to IRS with complete information can help the IRS assess the validity of your protest.

5. Present your explanations in a logical and readable way. To ensure that the IRS will quickly review your case, understand your reasons, and get into your position, you need to follow a structured, organized and logical writing explanation letter to IRS.

6. Tell the truth and only the truth when writing letter to IRS. State all the facts of your case in an explanation statement of penalties for perjury and specify that they are valid and accurate. Remember to sign the explanation document.

7. Proofread your explanation letter to IRS and make sure there are no mistakes and that you include all the details that can help you win your case.

When You’ll Write a Letter to IRS – What You Should Remember

The Internet is full of different explanation writing samples and tips on how to write a letter to IRS that will meet your requirements. So it seems a practical solution to use them as samples. However, a suitable written explanation sample letter to IRS is not enough to create your own. Although you can follow the writing structure we gave you earlier, it is very important to create a truthful explanation letter and clarify your reasons rather than copying others because that can only cause more trouble for you. It’ll make your IRS explanation letter writing more personalized and persuasive accordingly.

Final Thoughts on IRS Explanation Letter

Thus, there are different situations when writing to the IRS is necessary. In each case, the outcome depends on the presentation of your reasons for requesting a cancellation of the tax in the IRS explanation letter. Consequently, it is preferable to have your reasons with written evidence and send the explanation letter to IRS to help your case in the best possible way. Ensure no other unusual activities are going on under your name. If so, be ready to clarify any doubts the officer may have about it.

Get Professional Help with Writing Letters to IRS

Writing letters to IRS is an easy task for our competent experts. Within our professional SoP writing service, they’ll do their best for your application documents. You can contact us anytime and get a ready-made explanation letter to IRS within the deadline! We guarantee a quality writing result according to your requirements. You will be also satisfied with additional benefits to writing such as free edits and unlimited revisions, money-back options, and a plagiarism-free letter to IRS.